FMA TOOLKIT: PROPERTY TAXATION SYSTEM

The development of a First Nation tax system under the Fiscal Management Act (FMA) begins with the drafting and enactment of the core property taxation and property assessment laws. A First Nation must have both of these laws in place to establish the legal authority required to levy real property taxes and set out the administrative framework. FNTC staff work closely with the First Nation to ensure the First Nation’s proposed laws are consistent with the FMA, the Regulations, and the FNTC Standards

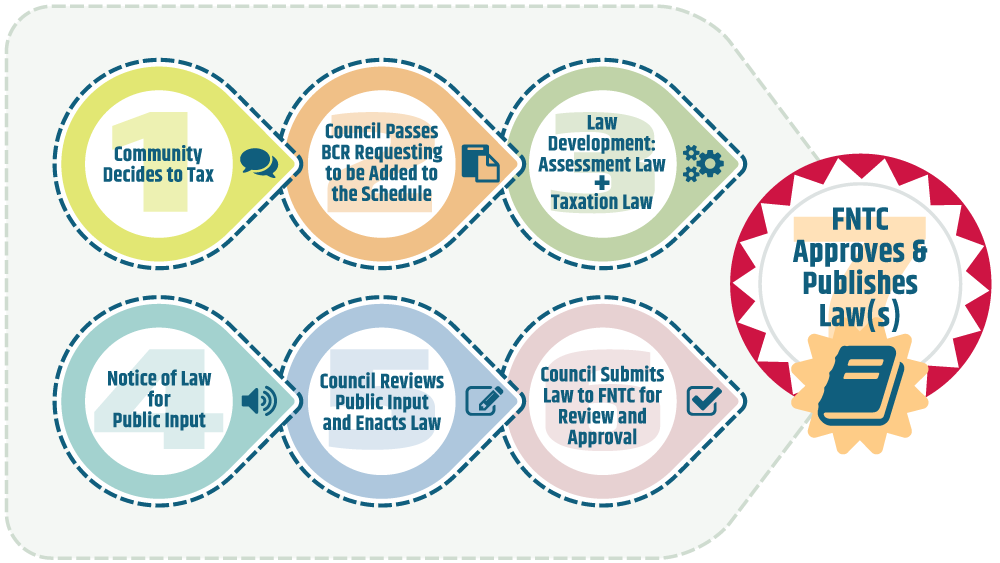

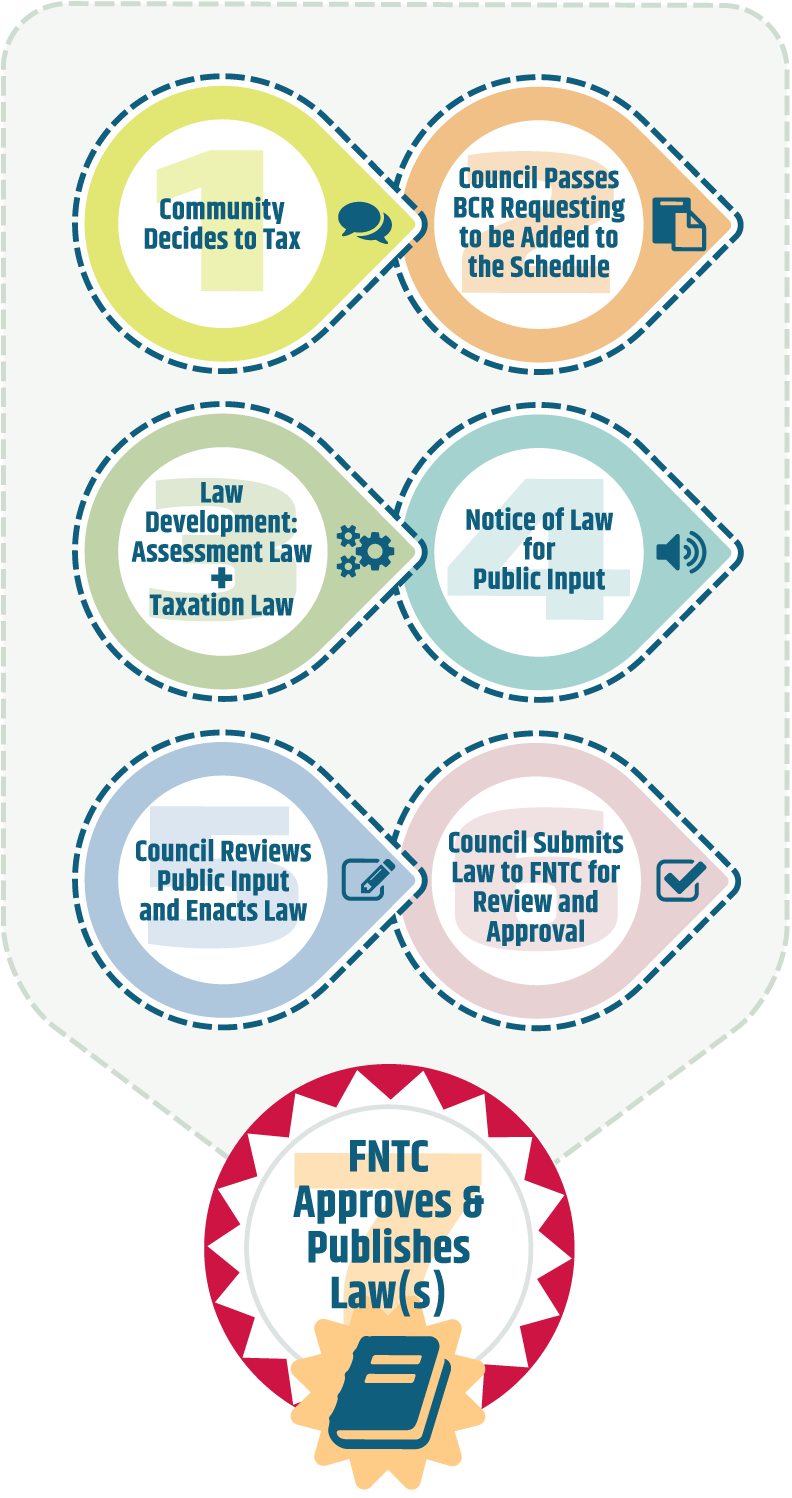

7 STEPS TO ESTABLISHING PROPERTY TAXATION LAWS

FNTC has established Standards for the Form and Content of First Nation Property Taxation Laws, and Standards for the Form and Content of First Nation Property Assessment Laws. Sample laws have been developed for each region in order to enable harmonization with provincial approaches where appropriate. See standards, guides and samples on right sidebar: or below on small screens:

Property Taxation Law

The enactment of a First Nation Property Taxation Law creates the legal framework to levy and enforce property taxation on reserve.

The Property Taxation Law establishes the property taxation system:

- Establishes how taxes are levied and what property interests are taxable

- Appoints the tax administrator to administer and enforce the property taxation system

- Specifies the duties of the tax administrator

- Establishes timelines and requirements for creating the tax roll and sending tax notices

- Provides for exemptions from taxation (if any)

- Provides for the imposition of penalties and interest on unpaid taxes

- Outlines the enforcement and collection mechanisms available to the First Nation

Submission:

- Download and review Standards for the Submission of Information Required Under s. 8 of the FMA

Information Accompanying Property Taxation Law:

SECTION 8 of the FMA and the Submission Standards require the following information:

- Interests or Rights Subject to the Law

- Assessment Practices

- Services and Service Agreements

- Notice Confirmations

- Additional Requirements for BC and Quebec

- Evidence that the law was duly made

- Confirmation Requirements, using Sample s. 8 Information Submission First Nation Certification letter

First Nations tend to establish real property taxes first, and then consider building on that established framework with additional local revenue laws such as service taxes, development cost charges, property transfer taxes and business activity taxes.

Property Assessment Law

A First Nation Property Assessment Law creates the legal framework for assessing interests in reserve lands.*

The First Nation appoints a qualified assessor to determine the assessed value of property interests to be taxed. The assessment law outlines how the assessor will assess the value of real property interests on a First Nation’s reserve lands.

The Property Assessment Law establishes the property assessment system:

- Appoints a qualified assessor

- Specifies the duties of the assessor

- Creates the timelines for conducting assessments

- Specifies the rules for determining the assessed values of properties

- Establishes the Assessment Review Board responsible for conducting appeals

- Creates timelines and rules for appealing assessments

Assessment laws under the FMA must comply with the FMA, the Regulations and the applicable FNTC Standards.

If you are considering developing a Property Assessment Law:

- Contact the FNTC to discuss the process Email FNTC Toll Free: 1-855-682-3682

- Request a FNTC presentation to your Chief & Council and senior staff

If your First Nation decides to proceed with Law Development

- Download and review the Standards for First Nation Property Assessment Laws and sample Property Assessment Laws

Notification Requirements:

When a First Nation implements property taxation there is a mandatory notification period. This is to ensure future taxpayers and community members have a fair opportunity to be heard.

Where a First Nation is implementing real property taxation:

- Section 6 of the FMA requires a notice to be:

a) Published in the First Nations Gazette

b) Posted in a public place on the reserve lands of the First Nation

c) Sent by mail or electronic means to the First Nations Tax Commission

- When implementing property taxation for the first time, the notification period must be at least 45 days, rather than 30 days.

- Where the First Nation has taxpayers or other persons on its reserve who will be subject to the tax, section 5.1 of the Notice Standards requires a First Nation implementing property taxation for the first time to publish or deliver the notice in at least one additional way:

a) In the local newspaper with the largest circulation

b) In a prominent place on the First Nation’s website, or

c) In a newsletter delivered to each taxpayer on the reserve

- For more information, view the Notification and Public Input Under the FMA webinar, review the Standards Respecting Notices Relating to Local Revenue Laws, Understanding the FMA Notice Requirements, or contact an FNTC advisor.

Submission:

When a First Nation is ready to submit their Property Taxation and Property Assessment Laws to the FNTC, section 8 of the FMA requires specific information accompany the law:

Information Accompanying Property Assessment Law:

Section 8 of the FMA requires the following information:

- A description of the lands, interests, or rights subject to the laws.

- A description of the assessment practices to be applied to each class of land, interest, or right.

- A description of service agreements and services provided.

- A description of the public notices provided by the First Nation, as well as any public consultation undertaken by the Council before making the law.

- Evidence that the law was duly enacted, i.e., the law must be signed by a quorum of Council members

Please note that there are additional requirements for First Nations located in BC and Quebec under the Submission Standards. You can confirm you have submitted the required information using the Sample section 8 Information Submission First Nation Certification Letter. For more information review the Standards for the Submission of Information Required Under Section 8 of the FMA or contact an FNTC advisor

Annual Tax Rates Law

First Nations are required to make an Annual Tax Rates Law setting out the tax rate to be applied to the assessed value of each class of property for the current taxation year. This law also establishes the minimum tax to be applied in that year, if any. Sometimes called the ‘mill rate’, the tax rates are typically determined by the budgetary requirements of the First Nation with consideration of the tax rates used by the adjacent local government (called the reference jurisdiction) and the resulting tax burden.

The Annual Tax Rates Law sets out the:

- Tax rate for each property class (established in the assessment law) in which a First Nation has assessable properties

The timing of when annual tax rates must be set is established in the First Nation’s property taxation law.

SECTION 10 of the Fiscal Management Act (FMA) and FNTC Standards for the Timing of First Nation Annual Rates and Expenditures Laws require First Nations to make annual rates laws and annual expenditure laws at least once each year of the taxation year to which the annual laws apply.

Annual tax rates laws enacted under the FMA must comply with all requirements and regulations made under the FMA, along with applicable FNTC standards.

When your First Nation is ready to proceed:

- Download and review the Standards for First Nation Rates Laws, the Standards for the timing of First Nation Annual Tax Rates and Expenditure Laws and sample Rates Law

- View Webinar: Annual Laws under the FMA

Notification Requirements:

- Download and review the Standards Respecting Notices Relating to Local Revenue Laws and Understanding the FMA Notice Requirements

- Before submitting the law to the FNTC for review and approval, the First Nation must give notice of the law in at least one of the ways listed in Section 1 (s. 1) of the Notice Standards

- View Webinar: Notification and Public Input Under the FMA

Submission:

- Download and review Standards for the Submission of Information Required Under s. 8 of the FMA (Submission Standards)

Information Accompanying the Annual Rates Law:

Section 8 of the FMA and s. 9, s. 11, s.12 of the Submission Standards require the following information:

- Annual Tax Rates Law Requirements

- Evidence that the law was duly made

- Confirmation Requirements

Annual Expenditure Law

First Nations are required to make an Annual Expenditure Law which provides the First Nation with the authority to expend revenues collected under their property taxation laws for the current taxation year.

The Annual Expenditure Law sets out how the First Nation:

- Intends to spend the property tax revenues it will collect

- Authorizes grant amounts

- Establishes reserve funds

Expenditure of local revenues can only be made in accordance with a budget set out in an expenditure law. Under the FMA, the budgeted expenditures must not exceed the budgeted revenues.

SECTION 10 of the Fiscal Management Act (FMA) and FNTC Standards for the Timing of First Nation Annual Rates and Expenditures Laws require First Nations to make an annual expenditure law at least once each year of the taxation year to which the annual law applies. The timing of annual expenditure laws is set out in the FNTC Standards for the Timing of First Nation Annual Tax Rates and Expenditures Laws.

Annual expenditure laws enacted under the Fiscal Management Act (FMA) must comply with all requirements and regulations made under the FMA, along with applicable FNTC standards.

When your First Nation is ready to proceed:

- Download and review the Standards for First Nation Expenditure Laws, the Standards for the timing of First Nation Annual Tax Rates and Expenditure Laws, sample Expenditure Law and the explanatory notes: Expenditure Categories for the Annual Expenditure Law

- View Webinar: Annual Laws under the FMA

Notification Requirements:

- Download and review the Standards Respecting Notices Relating to Local Revenue Laws and Understanding the FMA Notice Requirements

- Before submitting the law to the FNTC for review and approval, the First Nation must give notice of the law in at least one of the ways listed in section 2 of the Notice Standards

- View Webinar: Notification and Public Input Under the FMA

Submission:

- Download and review Standards for the Submission of Information Required Under s. 8 of the FMA (Submission Standards)

Information Accompanying the Annual Expenditure Law:

Section 8 of the FMA and s. 10, s. 11, s. 12 of the Submission Standards requires the following information:

- Annual Expenditure Law Requirements

- Evidence that the law was duly made

- Confirmation Requirements

Property Transfer Tax Laws

First Nations may enact a Property Transfer Tax (PTT) Law under the FMA.

PTT is generally paid by the transferee (or purchaser) of the property and is based on the fair market value of the property being transferred. The PTT is levied and paid at the time the transfer is registered in the land registry.

The PTT law establishes the PTT regime, and sets out:

- When and how the tax will be levied

- The rate of tax

- The exemptions from PTT

- Reporting requirements to Chief and Council as the tax authority

The FNTC has developed standards for PTT laws based on best practices, while allowing for local variation where appropriate and supporting harmonization with provincial jurisdictions where appropriate.

First Nations have discretion in setting their rate of PTT; however, their rate cannot exceed the provincial rate for PTT. If there is no PTT in their province, First Nations may choose any other province to follow for rates and exemptions.

PTT laws must be developed in compliance with the FMA, regulations and the the FNTC Standards. The First Nation must comply with the public input process requirements in s. 6 and s. 7 of the FMA, as well as the additional requirements set out in the Notice Standards. Once notice is completed, the First Nation enacts the PTT law and submits it for FNTC approval.

If your First Nation is considering a Property Transfer Tax Law

- Contact the FNTC to discuss the process Email FNTC Toll Free: 1-855-682-3682

- Request a FNTC presentation to your Chief & Council and senior staff

If your First Nation decides to proceed with Property Transfer Tax

- Download and review the Standards for First Nation Property Transfer Tax Laws, Regulations (if applicable) and sample Property Transfer Tax Laws

- Develop a law development work plan in conjunction with FNTC

- View webinar: Property Transfer Tax Under the FMA

Notification Requirements:

- Download and review the Standards Respecting Notices Relating to Local Revenue Laws and Understanding the FMA Notice Requirements

Notice Period and Additional Notice Requirements:

Where a First Nation is implementing a Property Transfer Tax Law:

- Section 6 of the FMA requires notice of the proposed law to be:

a) Published in the First Nations Gazette

b) Posted in a public place on the reserve lands of the First Nation

c) Sent, by mail or electronic means, to the First Nations Tax Commission

- The notification period must be at least 45 days.

- Where the First Nation has taxpayers or other persons on its reserve who will be subject to the tax, section 5.1 of the Notice Standards requires a First Nation implementing a property transfer tax to publish or deliver the notice in at least one additional way:

- View Webinar: Notification and Public Input Under the FMA

a) In the local newspaper with the largest circulation

b) In a prominent place on the First Nation’s website, or

c) In a newsletter delivered to each taxpayer on the reserve

Submission:

- Download and review Standards for the Submission of Information Required Under s. 8 of the FMA (Submission Standards)

Information Accompanying the Property Transfer Tax Law:

Section 8 of the FMA and s. 7, s. 11, s. 12 of the Submission Standards requires the following information:

- Notice Confirmations

- Evidence that the law was duly made

- Confirmation Requirements using the Sample Letter re: Submission of Information Required PTT under s. 8 [WORD DOC]

Taxpayer Representation to Council Law

First Nations may enact a Taxpayer Representation to Council (TRTC) Law under the FMA.

TRTC laws are intended to build and maintain strong taxpayer relationships. They establish procedures respecting the administration of the tax system. A TRTC law can establish key processes and opportunities for ongoing taxpayer and First Nation engagement so that taxpayers and the First Nation can communicate and articulate their concerns in an effective manner.

The procedures in a TRTC law can assist the First Nation in preventing disputes and can support the efficient resolution of disputes that arise.

The Standards for TRTC laws:

- Establish minimum notice periods for proposed tax rates and draft budgets

- Require provisions for taxpayer access to specific tax-related documents

- Require descriptions of methods that will be used to ensure on-going communication with taxpayers and allow taxpayer input to Council on taxation matters

- Includes dispute resolution procedures for taxpayers and First Nation representatives

The TRTC laws must comply with all statutory requirements, any regulations made under the FMA, and applicable FNTC Standards.

TRC laws must be developed in compliance with the FMA, regulations and the FNTC Standards. The First Nation must comply with the public input process requirements in s. 6 and s. 7 of the FMA. Once notice is completed, the First Nation enacts the TRTC law and submits it for FNTC approval.

If your First Nation is considering a Taxpayer Representation to Council Law:

- Contact the FNTC to discuss the process Email FNTC Toll Free: 1-855-682-3682

- Request a FNTC presentation to your Chief & Council and senior staff

If your First Nation decides to proceed with TRTC Law Development:

- Download and review the Standards for First Nation Taxpayer Representation to Council Laws, Regulations (if applicable) and sample Taxpayer Representation to Council Law

- Develop a law development work plan in conjunction with FNTC

Notification Requirements:

- Download and review the Standards Respecting Notices Relating to Local Revenue Laws and Understanding the FMA Notice Requirements

Notice Period and Notice Requirements:

Where a First Nation is implementing a TRTC Law:

- s. 6 of the FMA requires notice of the proposed law to be:

a) Published in the First Nations Gazette

b) Posted in a public place on the reserve lands of the First Nation

c) Sent, by mail or electronic means, to the First Nations Tax Commission

- View Webinar: Notification and Public Input Under the FMA

Submission:

- Download and review Standards for the Submission of Information Required Under s.8 of the FMA (Submission Standards)

Information Accompanying the Taxpayer Representation to Council Law:

Section 8 of the FMA and the Submission Standards require the following information:

- Notice Confirmations

- Description of the notices that were given and any consultation undertaken by the Council before making a taxpayer representation law

- Evidence that the law was duly made

- Confirmation Requirements

FMA TOOLKIT: ADDITIONAL LOCAL REVENUE LAWS AND RESOURCES